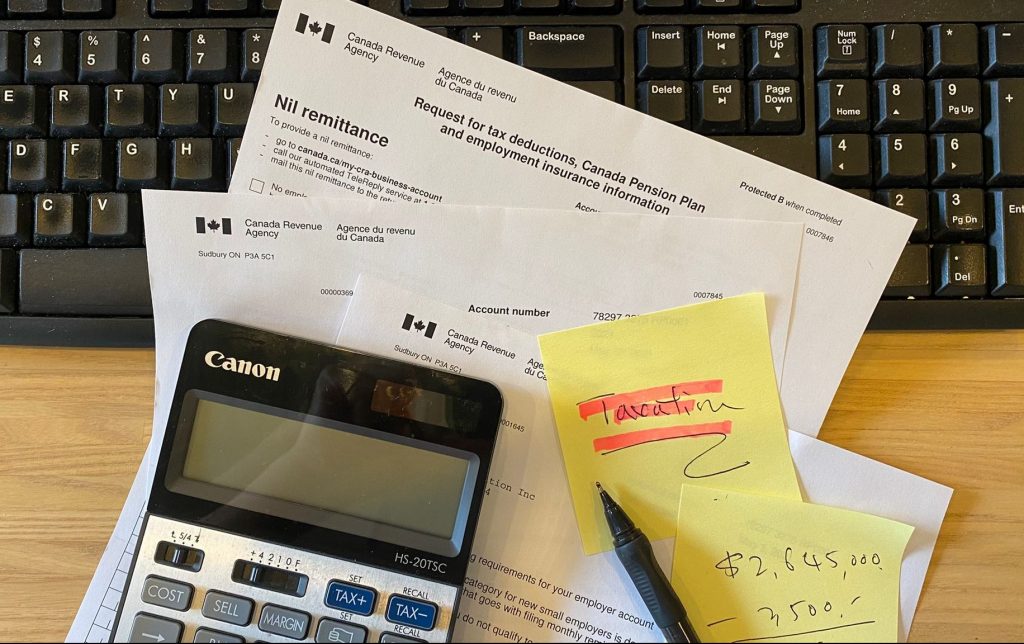

Taxation & Appeals

Are You in Trouble? Have You Been Audited? Losing Sleep Over Taxes?

As tax professionals, we at OneHub have the duty to provide the latest taxation information, tax support for multinationals and domestic companies. We work with clients to provide tax strategies and tax advice that are fit for purpose in the Canadian tax system of tomorrow!

CALL (905) 946-8898 NOW!

Explore How We Can Help You For The Tax Preparation. Contact Us!

Need some advice?

Our tax professionals offer connected services across all tax disciplines to help you keep your business competitive. We combine our exceptional knowledge and experience to create even more value for your organizations.

OneHub has competencies in business tax, international tax, transaction tax and tax-related issues associated with people, compliance and reporting and law.

We invite you to leverage our experience, knowledge and business insights to help you succeed.

Explore how we can help you add value across all areas of tax services. Contact us!

Tax Preparation Stressing You Out?

We have worked closely with many Small Medium Enterprises (SMEs) and Family Owned Enterprises and have successfully helped grow their businesses and transformed to a new generation of owners.

We provide tax services on your Income Tax preparation, minimization of Income Tax, Tax planning and reviews to help you smooth out the problems and issues so that you can stop worrying and focus on your long term goal.

Explore How We Can Help You For The Tax Preparation. Contact Us!

Facing Challenges And A CRA Audit?

We have the expertise and resources to help you have an impact. In the event that you are audited, you should be well prepared. Organize your documents and you should be able to present your case correctly and protect your rights.

OneHub provides tax representation services, we use our vast experience, and our team meets to evaluate and assess the situation. Our audit representative develops the strategy used to defend the taxpayer’s position. We will assist the taxpayer in preparing all documents requested by the taxing authority and typically attend all meetings and handle correspondence on behalf of the taxpayer.

Explore What Approach, And How We Handle Your Case. Contact Us!

Have You Been Audited?

The CRA’s main business, however, is to collect money for the government. Without the IRS, the government could never function. If you are audited by the CRA, you have certain rights and you must make sure that your rights are protected. If you believe that you did nothing wrong than you have nothing to worry about.

Don’t be panicked, it is very common that at the end of the audit there are no changes. If you’re well prepare and organize your information, sometimes the CRA may even owe the taxpayer money due to the fact that they have under reported their expenses or the taxpayer was unaware that certain expenses were tax deductible.

Explore How OneHub Can Solve Your Tax Audit Problem And Negotiations. Contact Us!

OneHub Can Help You!

OneHub is uniquely positioned to provide detailed advice and representation in all areas of tax dispute resolution. We will bring our experience in dealing with CRA taxation authorities, work with clients towards a timely and cost-effective resolution of tax disputes.

Our proven track record of successfully resolving tax disputes for Preparation of Notices of Objection to sales tax assessments; assisting clients to prepare for and manage sales tax and customs audits, making representations on behalf of companies/organizations to federal and provincial taxation authorities.

Explore How To Save Your Tax Dollars Than Our Fees. Contact Us!

Anthony Lai, CPA, CA, LPA

Anthony Lai qualified as a CA in 2001. He is a strong believer in proactive tax planning to maximize wealth and minimize future taxes. With his tax & audit experience gained from national firms, Anthony provides comprehensive tax, financial and business advice to help SME clients achieve objectives in tax efficient ways. He services SME, charities, individuals, and non-resident investors in tax, audit and finance areas. His areas of expertise include tax planning, tax compliance, business acquisition, divesture, audit, financial reporting and corporate finance.

Anthony believes in giving back to the community and gives workshops at community centres to help new immigrants, start-up entrepreneurs, and seniors over the last 20 years. He loves travelling with family over the world to enrich life experiences.

CONTACT ANTHONY AT:

- Email: anthony@onehub.ca

- Phone: (416) 722-2893